georgia film tax credit history

Exploring Georgias Film Industry Tax Credits Series 0. Since many production companies dont have enough tax liability to utilize the full.

Georgia Senate Won T Cap Film Credit At 900 Million Variety

Under the act the Georgia movie tax credit is available to both Georgia residents and non-residents.

. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. Companies for services performed in Georgia when getting the Georgia. Georgias film tax credit is unique because it has no cap and is transferable.

One section included placing a cap on the Georgia film tax credit at 900 million. A valid certification must be. Instructions for Production Companies.

There is a salary cap of 500000 per person per production when the employee is paid by salary which is defined by the Georgia film incentives website as being paid with a W2. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule. Third party audit firms interested in becoming certified eligible auditors will find a list of qualifications and the application in the Film Tax Credit 3rd Party Eligible Auditor Application.

Eligible companies can earn up to a 30 tax credit for doing film production work in Georgia. In 2019 Georgia gave out 850 million in credits. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

GA Film Tax Credit - List of Expenditures final 12-14-18pdf 3015 KB. An additional 10 credit can be obtained if the. How to File a Withholding Film Tax Return.

Projects first certified by DECD on or after 1121 with. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Many are unaware of this but Georgia is known as the Hollywood of the South because of all the film.

The Georgia film tax credit has worked as intended and built an industry that spends nearly 3 billion per year in the state and employs tens of thousands of Georgians in. Most of the credits are purchase for 87-92 of their face value. A taxpayer seeking preapproval for Post Production Film Tax Credit must file electronically through Georgia Tax Center GTC.

Georgias Entertainment Industry Investment Act provides a 20 tax credit for filming and entertainment industries that spend 500000 or more on production and post. Credit Code 122 company name is the movie company no. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their.

About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified. Film tax credit GA. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit.

How-To Directions for Film Tax Credit Withholding. Third Party Bulk Filers add Access to a Withholding Film Tax Account. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified.

More than the state spends on child welfare or state prisons or. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. Register for a Withholding Film Tax Account.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Television films pilots or. Post Production Film Tax Credit.

This is perhaps the easiest way to reduce your Georgia tax liability. So for example if you had a Georgia income tax. The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits.

April 09 2014. Important Changes to the Georgia Film Tax Credit. 20 base transferable tax credit.

Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. In the past few years Georgia has become a hub for film and television businesses spanning commercials to feature films to television series. GEIIA also known as the film tax credit passed in 2005.

Claim Withholding reported on the G2-FP and the G2-FL. September 8 2020. If the production company pays an individual for services as a loan-out a personal.

The bill was headed to a full vote in the State Senate when it was sent back to the rules. By News on November 9 2016 Features.

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Essential Guide Georgia Film Tax Credits Wrapbook

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

Essential Guide Georgia Film Tax Credits Wrapbook

Celebrating The Georgia Film Industry Stranger Things Filming Locations Georgia Georgia On My Mind

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

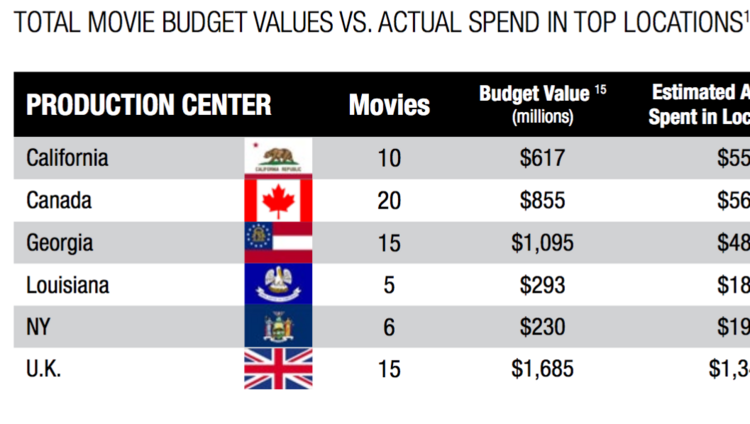

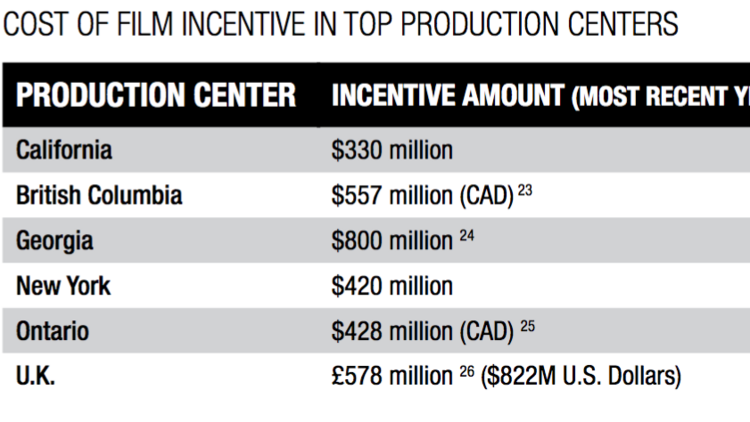

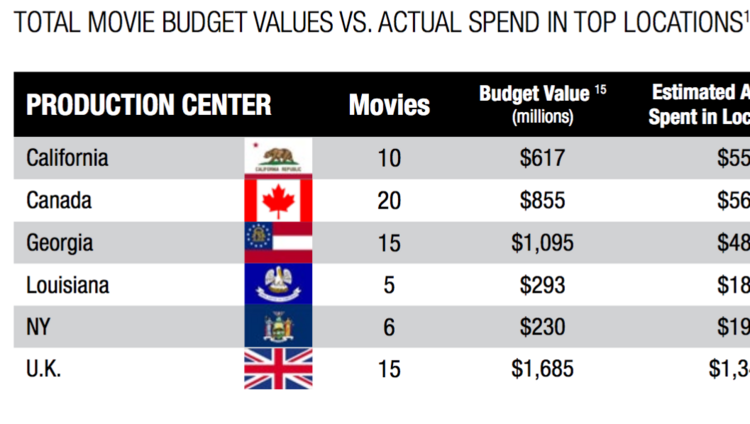

Industry S Most Competitive Incentives Lure Top Production Companies To Georgia Georgia Department Of Economic Development

The Secret Sauce Of Georgia S Extraordinary Film Industry Georgians Saportareport

Opinion Ga S Film Tax Credits Are Big Budget Flop

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle